Your pensions, clear as a picture!

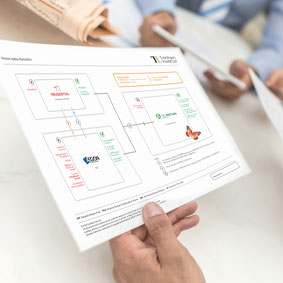

Our first task will be to identify each pension piece and understand how it works. We’ll then separate the elements and make sense of them, translating the jargon into plain language, so it can be easily understood. We will then visualise everything in a simple diagram and present it to you.